Buy an Ethereum Call Options

Expecting Ethereum’s price to go up? A call option lets you capitalize on the upside with limited risk. Here’s a simple guide to buying Ethereum call options and getting started with options trading.

- Choose a Trading Platform

Popular platforms for crypto options include Deribit, Binance, and OKX. Look for platforms that are secure, user-friendly, and support Ethereum options. - Deposit Funds

Add Ethereum or fiat currency to your account. You may need ETH to trade, so prepare to transfer it from an exchange like Coinbase or Kraken if necessary. - Place Your Order

Select ETH, choose a call option, and specify the strike price and expiration. Review the premium cost and confirm your trade.

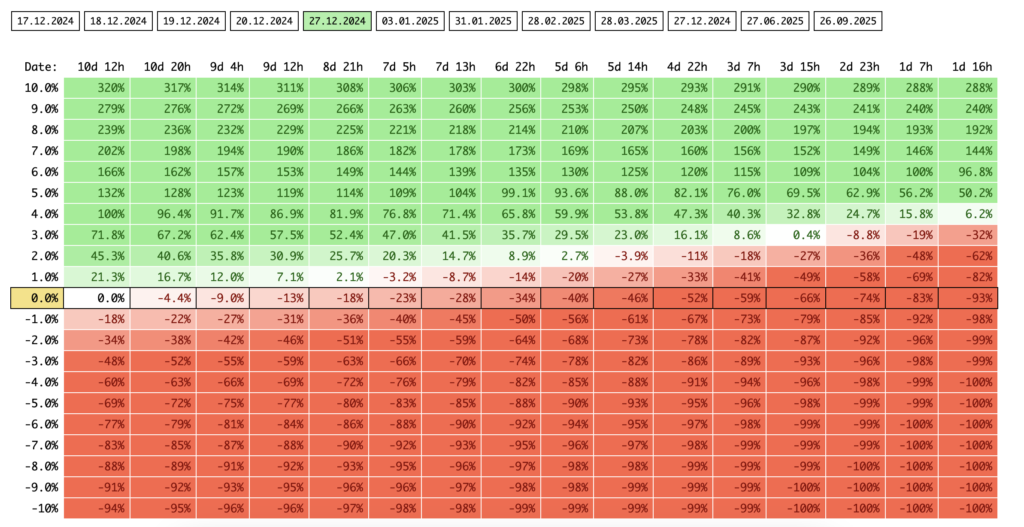

Profit Call Ethereum Calculator

Next Steps After Buying an Ethereum Call Options

Once you own the call option, track Ethereum’s price movement:

- If ETH’s price rises above your strike price, your call option becomes valuable. You can:

- Exercise the Option to buy ETH at the strike price.

- Sell the Option before expiration to lock in profits.

- If ETH’s price stays below the strike price, the option expires worthless, and you lose only the premium you paid.

Key Tips for Success

- Start Small: Begin with small trades to learn the ropes without risking too much.

- Time It Right: Shorter expirations offer quicker returns but are riskier; longer expirations give you more time to profit.

- Follow the Market: Stay updated on Ethereum news and trends to make informed decisions.

- Set a Budget: Only invest what you can afford to lose—options are high-risk instruments.

- Have an Exit Plan: Decide early if you’ll exercise, sell, or let the option expire.

Buying Ethereum call options can be a powerful way to profit from price increases while limiting your risk. Start with small steps, stay informed, and enjoy exploring the exciting world of crypto options.