Buy an Ethereum Put Options

Think Ethereum’s price might drop? A put option lets you profit from falling prices or protect your portfolio. Here’s a simple guide to buying Ethereum put options and getting started with crypto options trading.

- Choose a Trading Platform

Popular platforms for Ethereum options include Deribit, Binance, and OKX. Check their fees, security, and whether they support ETH put options. - Fund Your Account

Deposit ETH or fiat currency to your trading account. If you don’t already have ETH, you can buy it on exchanges like Coinbase or Kraken and transfer it to your options platform. - Buy Your Put Option

Navigate to the options trading section, choose ETH, and select a put option. Pick your strike price and expiration, review the premium cost, and confirm the purchase.

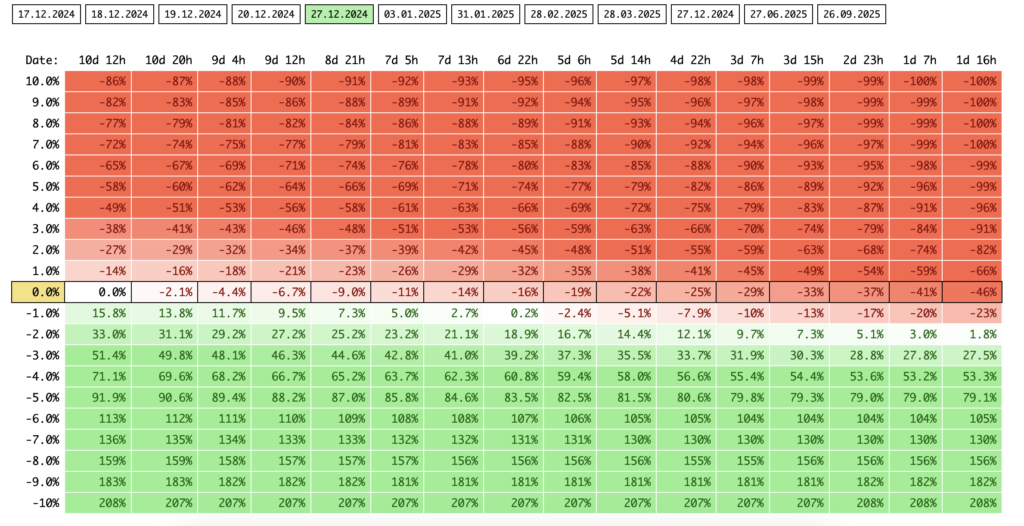

Profit Put Ethereum Calculator

Next Steps After Buying an Ethereum Put Options

Once you’ve purchased the put option, watch Ethereum’s price movements:

- If ETH’s price falls below the strike price, your put option gains value. You can:

- Exercise the Option to sell ETH at the strike price.

- Sell the Option before expiration to lock in profits.

- If ETH’s price stays above the strike price, the option expires worthless, and you lose only the premium.

Key Tips for Success

- Start Small: Begin with small trades to limit your risk while learning.

- Track the Market: Stay informed on Ethereum’s price trends and news.

- Time Your Expiration: Short-term options may be cheaper but carry higher risk. Longer expirations offer more flexibility.

- Set a Budget: Only invest money you can afford to lose—options are high-risk.

- Plan Ahead: Decide early if you’ll exercise, sell, or let the option expire.

Buying Ethereum put options can be a great way to hedge against price drops or profit from bear markets. Take it slow, learn the basics, and start exploring this exciting tool for trading.