Buy put Bitcoin options

So, you’re thinking about buying a Bitcoin put option — smart move if you’re betting on the price dropping or just want to protect yourself from market dips. Let’s break it down step by step so you can dive into the world of puts with confidence.

- Choose a Platform: Popular options include Deribit, Binance, and OKX. Check their reputation and fees.

- Fund Your Account: Deposit Bitcoin or fiat currency.

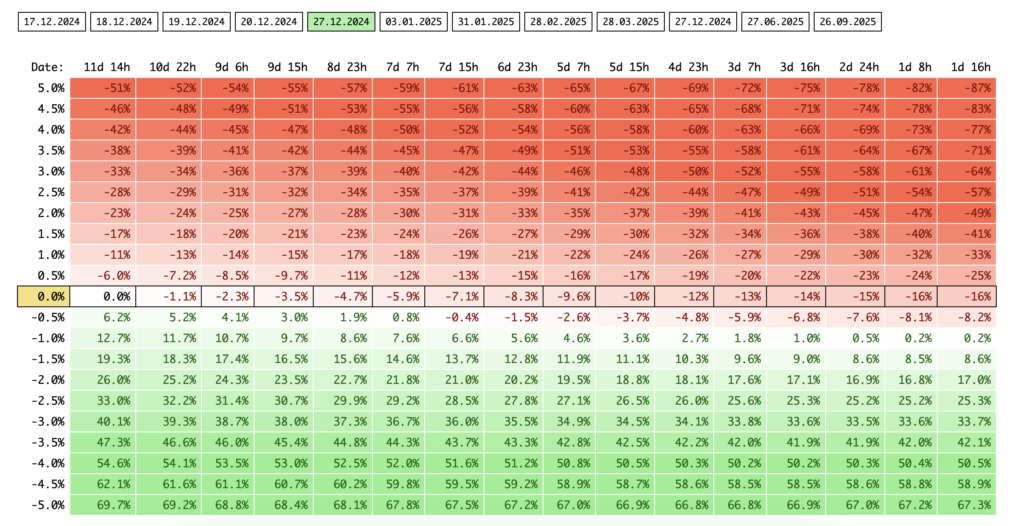

- Understand cost of put Bitcoin options: The cost (premium) depends on the strike price, expiration date, and market volatility.

- Buy the Put: Select ATM, OTM or ITM the option, choose a strike price and expiration date, and confirm the purchase. Or simulate on our Profit Put Bitcoin Calculator:

Profit Put Bitcoin Calculator

Next Steps After Buying a Bitcoin Put Option

Monitor the price of Bitcoin. If it drops below the strike price:

- Exercise the Option to sell.

- Sell the Option for a profit.

- Let It Expire if the price doesn’t drop, losing only the premium.

Start small, learn the ropes, and trade wisely. Good luck! 🚀

Tips for Success

Do your research: Keep an eye on Bitcoin price trends and news.

Don’t forget about FOMO, fear and greed: Think about your psychological and emotional state at the moment.

Start small: Practice with small trades until you get the hang of it.

Risk management: Only use money you can afford to lose, and don’t put all your eggs in one basket.

Stop loss: This trading tool automatically closes a position when the asset price reaches a predetermined level, helping to limit potential losses.