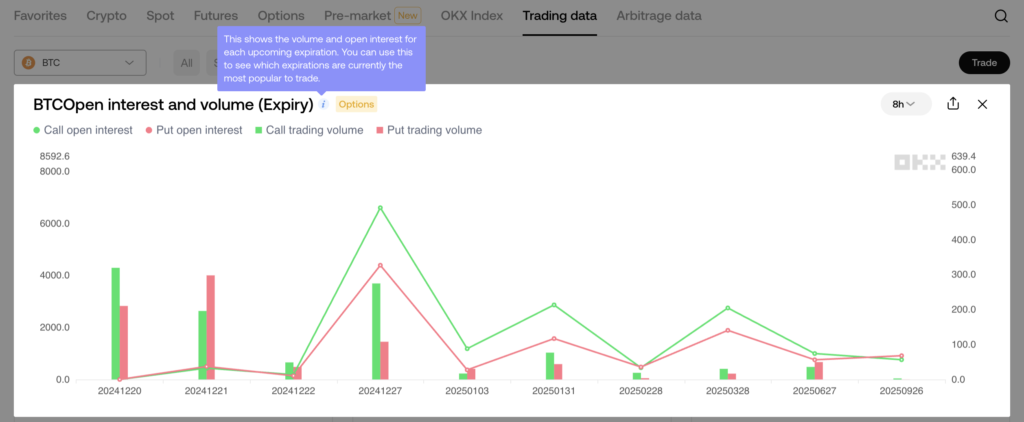

Open interest and trading volume by expiration for Bitcoin options

Analyzing open interest (OI) and trading volume by expiration provides critical insights into market expectations and liquidity concentration for Bitcoin options.

- OI by expiration shows the total outstanding contracts set to expire on a specific date.

- Volume by expiration indicates trading activity for contracts tied to a particular expiration.

Key Insights:

- Liquidity Concentration: High OI near certain expirations suggests pivotal price levels or major events.

- Market Sentiment: Surges in volume before specific expirations reflect active positioning or hedging.

- Expiration Cycles: Monthly and quarterly expirations often see spikes in activity due to settlement and rollover strategies.

Applications for Traders:

- Strategy Timing: Align trades with high-volume expirations to ensure liquidity.

- Volatility Projections: Monitor OI and volume clusters for insights into expected price movements.

- Risk Management: Track expirations to manage potential pin risk or gamma squeezes.

By evaluating OI and volume by expiration, traders can anticipate liquidity shifts, refine their timing, and better understand market drivers, enhancing their overall trading strategies.