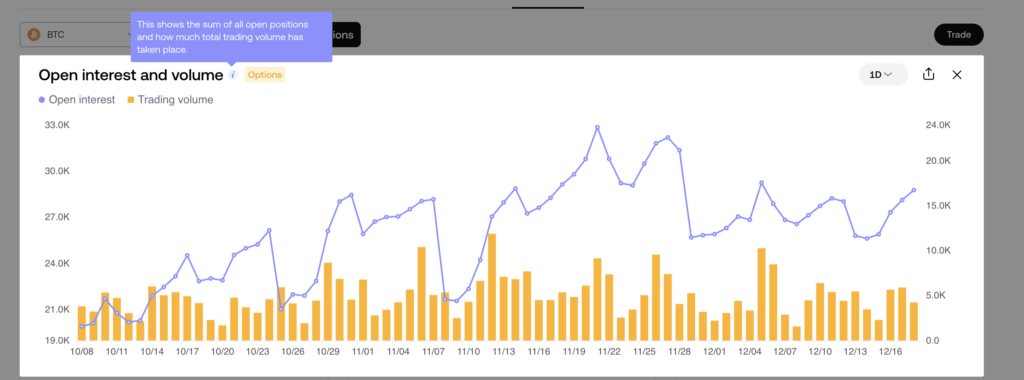

Open interest and volume of Bitcoin options

Bitcoin options are key tools for hedging, speculation, and portfolio management. Two metrics—open interest (OI) and volume—are crucial for understanding market dynamics.

Open Interest (OI):

- Represents outstanding, unsettled contracts.

- High OI indicates strong market participation and liquidity.

- Increasing OI often signals trend strength, while declining OI suggests waning interest.

Volume:

- Reflects the total contracts traded within a specific period.

- High volume signals active trading and potential market volatility.

- Volume resets daily, offering insights into short-term activity.

Traders can use OI and volume to identify support/resistance levels, monitor expiration cycles, and gauge sentiment via put/call ratios. These metrics provide actionable insights, making them vital for navigating the dynamic Bitcoin options market.

Key Insights:

- Rising OI with high volume suggests sustained trends.

- Flat OI with high volume indicates short-term speculation.

- Dropping OI with high volume may precede trend reversals.