Sell Bitcoin Call Options

Expecting Bitcoin’s price to stay steady or decline? Selling a call option allows you to generate income from the premium without outright selling Bitcoin. Here’s a quick guide to help you sell your first Bitcoin call option.

- Pick a Platform: Use platforms like Deribit, Binance, or Gate.io that support Bitcoin options trading. Check fees and liquidity.

- Fund Your Account: Deposit Bitcoin to cover potential obligations if the option is exercised.

- Understand Cost and Risk: The premium you earn is your maximum profit, but you risk selling Bitcoin below market value if the price rises above the strike price.

- Sell Your Call: Select Bitcoin, choose the call option, set the strike price and expiration, and confirm the trade.

Selling call options can be a strategic way to earn consistent income, especially in stable or bearish markets.

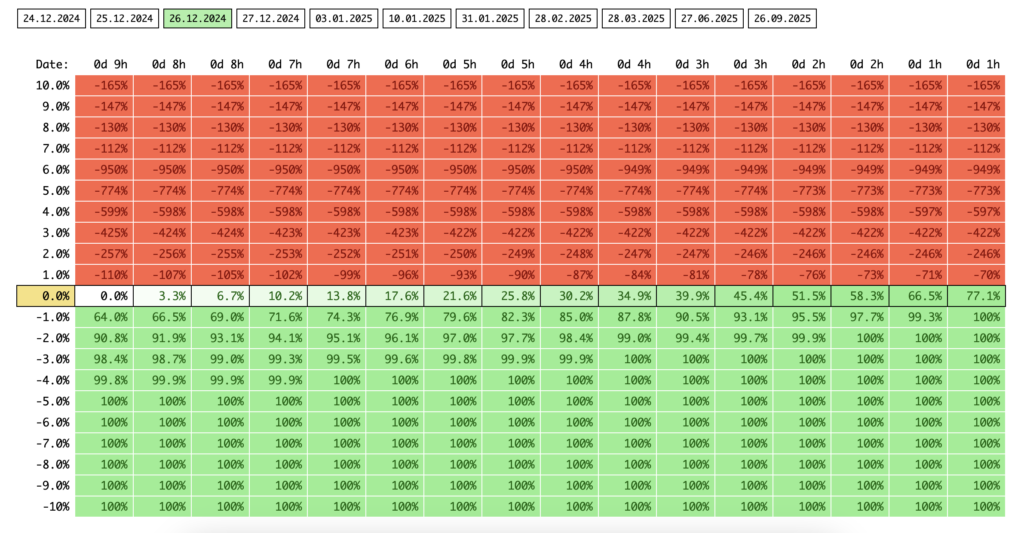

Profit Call Bitcoin Calculator

Next Steps After Selling a Bitcoin Call Options

If Bitcoin’s price remains below the strike price:

- Keep the Premium as profit while retaining your Bitcoin.

- Let It Expire without further action if the buyer doesn’t exercise the option.

If Bitcoin’s price exceeds the strike price:

- Sell Bitcoin at the agreed strike price, potentially below market value.

Key Tips for Success

- Manage Risk: Ensure you’re comfortable with the possibility of selling Bitcoin if the price spikes.

- Watch the Market: Monitor Bitcoin’s price and implied volatility to time your trades.

- Use Covered Calls: Hold the equivalent Bitcoin to minimize risks if the option is exercised.

- Plan Ahead: Decide in advance whether you’ll close the position early or let it expire.

Selling call options can be a strategic way to earn consistent income, especially in stable or bearish markets.