Exploring OKX Crypto Options Trading exchange: Expert Review

OKX is a prominent player in the crypto trading industry, offering a comprehensive suite of tools for trading crypto options. This review explores its strengths, weaknesses, and fee structure, especially for options trading.

Exploring OKX exchange for Crypto Options Trading

Once you’ve completed your OKX registration, you’ll be taken straight to the platform’s main screen. Here, you’ll find an intuitive interface that includes key sections for trading, analytics, and account management. Let’s take a closer look at the key elements of the interface so you can quickly get up to speed and start working with crypto options.

From the main screen, we go to options trading and look at all the offers.

In this review, we will look at the OKX platform interface for trading crypto options on Bitcoin and Ethereum only.

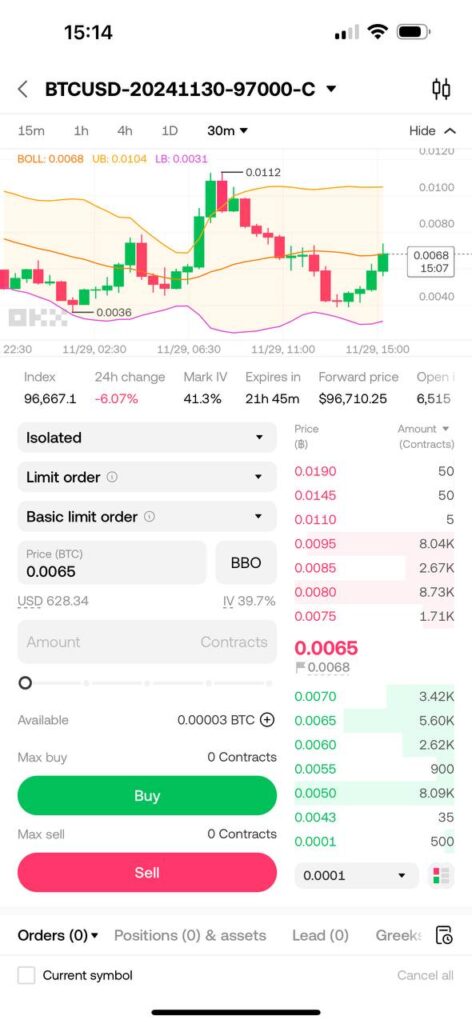

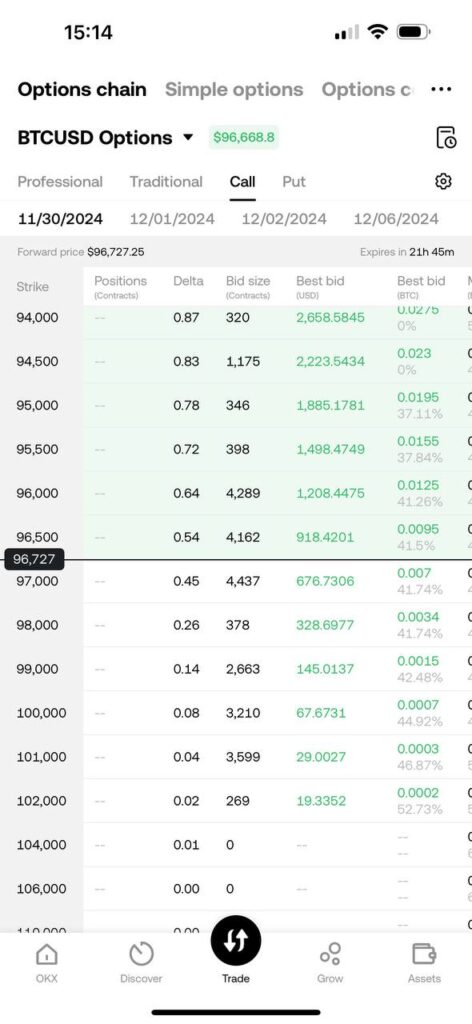

Standard Basic Crypto Options Trading on OKX

I show how you can buy an option on crypto and what purchase settings are available — trade options usually like pro. Buying cryptocurrency options in the standard mode offers more opportunities for analysis and customization of the deal. You choose the underlying asset, specify the strike price, expiration date and the type of option – call or put. It is also important to consider the premium that needs to be paid for purchasing the option and the potential profitability depending on the change in the asset price.

The standard approach requires a trader to have a greater understanding of the market situation and the mechanics of options. Here, you can take volatility into account, build hedging strategies or even combine options to create complex structures.

This method allows experienced traders to better manage risks and benefit from complex market movements. To trade successfully, it is important to be able to analyze charts, understand Greeks and assess probabilities in order to minimize losses and maximize profits.

Simple options at OKX

The OKX platform has a simplified options buying section — it’s really simple and clear even for beginners. You can quickly select the underlying asset, specify the amount and direction of the transaction (up or down), and then click just one button to confirm. This approach makes options accessible to a wide audience, but there is a downside.

A simplified interface and minimal analytical load can create the illusion among users that buying options is something like a bet in a casino. This is dangerous, especially for those who do not understand all the risks associated with derivatives trading.Options trading is not gambling, but a tool that requires a deep understanding of the market and strategy. Therefore, it is important to approach such transactions consciously, learning the basics of risk management and market analysis, even if the interface makes the process as easy as possible.

OKX analytics for crypto options trading

The OKX platform provides a wide range of analytical tools for working with crypto options, which makes it attractive for both beginners and experienced traders.

To analyze volatility and determine optimal entry points, the platform offers option price charts, historical volatility, and data on changes in Open Interest. This helps traders better understand the market sentiment and current trends.

In addition, the platform offers analytical metrics such as Greeks (Delta, Gamma, Theta, Vega), which allow you to assess the risks and behavior of options when market conditions change. For example, Delta shows how much the option price will change when the underlying asset moves, and Theta shows how much the premium shrinks over time.

For those who prefer to build complex strategies, OKX supports visualization of potential profit and loss (P/L) for each scenario. This is convenient for testing different strategies and evaluating their effectiveness.

With the help of such tools, traders can make more informed decisions, minimizing risks and increasing the chances of successful trading.

Building Trading Strategies with OKX Position Builder

The Position Builder tool on the OKX platform allows traders to create and test complex trading strategies using crypto options. It’s an ideal solution for those looking to combine various positions and evaluate their potential profitability or risk in advance.

Key Features of Position Builder:

- Strategy Constructor You can combine call and put options with different strike prices, expiration dates, and volumes. This enables you to model popular strategies like straddles, strangles, iron condors, and more, or create your own unique combinations.

- Risk and Profitability Analysis The tool automatically generates profit and loss (P/L) charts for the created strategy. This allows you to visualize how the position will perform under different price movement scenarios of the underlying asset.

- Interactive Interface All changes to the strategy are instantly reflected on the charts and tables. You can adjust option parameters (e.g., strike price or expiration date) and see how they impact the overall strategy.

- Cost and Greeks Calculations Position Builder displays the premiums you will pay or receive for each component of your position, as well as key analytical metrics like Delta, Vega, Theta, and Gamma, helping you better understand the behavior of your strategy.

Position Builder is perfect for experienced traders who utilize advanced risk management strategies. It’s also beneficial for those who want to test their ideas and see potential outcomes before entering a trade.

OKX Position Builder is a powerful tool for analyzing and building strategies, enabling traders not only to execute trades but also to gain deeper insights into the crypto options market. With its flexibility and visualization capabilities, you can enhance your trading efficiency and minimize risks.

Account Modes on OKX for crypto options trading

Here’s a table explaining the four Account Modes on the OKX platform, specifically for options trading:

| Account Mode | Options-Specific Features | Requirements & Best For |

|---|---|---|

| Spot Mode | – Only allows buying Call and Put options. – Risk is limited to the premium paid for the options. | – No minimum balance required. – Best for beginners or traders avoiding margin trading. |

| Spot and Futures Mode | – Enables both buying and writing Call and Put options. – Selling options involves higher risks and margin requirements. | – Suitable for intermediate traders ready to manage risks actively. |

| Multi-Currency Margin Mode | – Provides leverage for options trading. – High collateral required for buying (e.g., 50%), lower for selling (e.g., 5%). – Obligations are covered by the combined margin from all currencies. | – Requires a minimum balance of $10,000. – Best for experienced traders with diversified portfolios. |

| Portfolio Margin Mode | – Risk is assessed across the portfolio, reducing margin requirements for complex strategies. – Supports advanced combinations like iron condors, straddles, and strangles. | – Requires a minimum balance of $10,000. – Ideal for advanced users and institutional investors. |

Key Takeaways:

- Spot Mode: Beginner-friendly, allows only buying options.

- Spot and Futures Mode: Adds the ability to sell options, with more risk and complexity.

- Multi-Currency Margin Mode: Leverages multiple currencies for margin, offering efficiency for large balances.

- Portfolio Margin Mode: Optimized for professionals, minimizes margin requirements for advanced strategies.

Mobile Version of OKX

OKX offers a fully optimized mobile app, ensuring that traders can manage their accounts and execute trades on the go. The app is available for both iOS and Android, providing a seamless experience for crypto and options trading.

Key Features of the OKX Mobile App:

- Intuitive Interface

The app is designed for ease of use, with clear navigation and an intuitive layout. This makes it accessible for both beginners and advanced traders. - Full Trading Functionality

You can perform all essential trading actions, including:- Buying and selling options.

- Viewing live market charts and prices.

- Managing positions and portfolios in real-time.

- Push Notifications

Stay updated with customizable alerts for market movements, position updates, and system notifications. - Analytics on the Go

Access in-depth analytics and reports, including Greeks and profit/loss charts, directly from the app. - High Security

The mobile app incorporates robust security features like biometric login, two-factor authentication (2FA), and encryption to protect your assets and data.

The OKX mobile app is ideal for traders who need flexibility and mobility. Whether you’re a casual trader or a professional managing complex portfolios, the app ensures you stay connected to the market no matter where you are.

With its responsive design and full feature set, the OKX mobile app is a valuable tool for staying ahead in the fast-paced world of crypto options trading. Download it from the App Store or Google Play Store to get started!

OKX Evaluation: 10-Point Scale

Here’s a detailed assessment of OKX for crypto options trading based on key factors:

- Fee Structure (7/10)

The platform employs a tiered fee system for options trading. The basic maker and taker fees start at 0.02% and 0.03%, respectively, for regular users. High-volume traders or those holding OKB tokens benefit from discounted rates. VIP tiers, determined by 30-day trading volumes and asset balances, offer even lower fees, which are competitive compared to industry standards. OKX offers competitive maker and taker fees for options trading, with discounts for high-volume traders and OKB holders. However, its tiered system can be complex for beginners to navigate. - Liquidity and Market Depth (7/10)

OKX provides excellent liquidity, ensuring tight spreads and minimal slippage. It’s particularly strong in highly traded options like BTC and ETH. - User Interface and Platform Stability (9/10)

The platform offers a sleek, intuitive interface with a stable trading environment, both on desktop and mobile. This makes it accessible for traders of all levels - Range of Available Options Contracts (8/10)

OKX supports a diverse range of options, including various strike prices and expirations. However, compared to some niche derivatives platforms, its range could be broader - Security Features (9/10)

With robust security measures such as multi-signature cold wallets, two-factor authentication (2FA), and an insurance fund, OKX prioritizes user safety - Reputation and Regulatory Compliance (8/10)

OKX is well-regarded in the industry, but like many crypto exchanges, it operates in a regulatory grey area in some jurisdictions. Users should verify compliance based on their location - Customer Support Quality and Availability (7/10)

Customer support is responsive through multiple channels, though there are occasional delays during high-demand periods - Mobile App and On-the-Go Trading Capability (9/10)

The OKX mobile app offers a seamless trading experience, featuring real-time charts, notifications, and easy access to account management tools - Educational Resources and Market Analytics Tools (8/10)

OKX provides solid educational content, including tutorials and market insights, but advanced analytics could be more comprehensive - Fiat On-Ramp and Withdrawal Options (7/10)

While OKX supports fiat deposits and withdrawals through third-party services, the process is less streamlined compared to fiat-focused exchanges

Overall Score: 7.9/10

OKX delivers a seamless experience across desktop and mobile platforms. The mobile app is particularly useful for traders who need to monitor positions and execute trades on the go. Moreover, OKX’s integration of trading bots allows users to automate strategies, catering to both passive and active trading styles. For those seeking a versatile and secure environment to trade crypto options, OKX is a top contender.

OKX is a strong contender for crypto options trading, excelling in liquidity, security, and usability. However, areas like fiat integration and customer support response time could see improvements.